Click to get this free reportĪmerican Axle & Manufacturing Holdings, Inc. 15 on whether to authorize nurse negotiation leaders to call a strike at Twin Cities and Twin Ports hospitals.

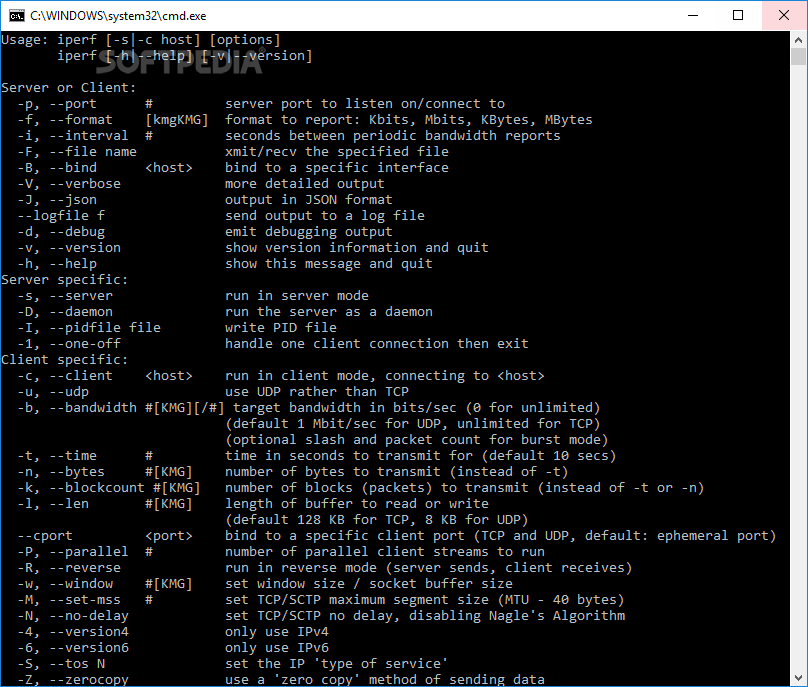

#WHAT IS CFOSSPEED 10.25 DOWNLOAD#

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. The Minnesota Nurses Association said its members will vote Aug. To follow AXL in the coming trading sessions, be sure to utilize. MacDonald will be replacing Stephen Burwash in the position, making him the fourth person to assume the role in the past two years. Audio ALC1220-VB, Intel GbE LAN with cFosSpeed, CEC 2019 ready, RGB FUSION 2.0 Supports AMD Ryzen 2nd Generation/. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1. Trent MacDonald is the new chief financial officer of Hexo Corp. The Zacks Industry Rank gauges the strength of our industry groups by measuring the average Zacks Rank of the individual stocks within the groups. This industry currently has a Zacks Industry Rank of 160, which puts it in the bottom 38% of all 250+ industries. The Automotive - Original Equipment industry is part of the Auto-Tires-Trucks sector. The Automotive - Original Equipment industry currently had an average PEG ratio of 1.06 as of yesterday's close. AXL's full-year Zacks Consensus Estimates are calling for earnings of 1.34. The PEG ratio is similar to the widely-used P/E ratio, but this metric also takes the company's expected earnings growth rate into account. Our most recent consensus estimate is calling for quarterly revenue of 1.35 billion, up 0.26 from the year-ago period. For comparison, its industry has an average Forward P/E of 14.19, which means AXL is trading at a discount to the group.Īlso, we should mention that AXL has a PEG ratio of 0.91. Looking at its valuation, AXL is holding a Forward P/E ratio of 7.31. AXL is holding a Zacks Rank of #3 (Hold) right now. Over the past month, the Zacks Consensus EPS estimate has moved 0.3% higher. The company that began as a nine-seat A&W root beer stand is recognized today as a top employer and for its superior business operations, which it conducts based on five core. Ranging from #1 (Strong Buy) to #5 (Strong Sell), the Zacks Rank system has a proven, outside-audited track record of outperformance, with #1 stocks returning an average of +25% annually since 1988. At Marriott, we never stop searching for inventive ways to serve our customers, provide opportunities for our associates, and grow our business. Our system takes these estimate changes into account and delivers a clear, actionable rating model. We developed the Zacks Rank to capitalize on this phenomenon. Our research shows that these estimate changes are directly correlated with near-term stock prices. As such, positive estimate revisions reflect analyst optimism about the company's business and profitability. These recent revisions tend to reflect the evolving nature of short-term business trends. Investors might also notice recent changes to analyst estimates for AXL.

0 kommentar(er)

0 kommentar(er)